Average Cost Of Whole Life Insurance

Average Cost Of Whole Life Insurance - Premiums are the same until the policy is paid after 20 years. As of september 2024, a term life policy averages $26 per month, while whole life coverage for the same amount can cost around $450. How much is a whole life insurance policy per month? Whole life insurance is a permanent life insurance policy that combines a death benefit with a cash value account you can access during your lifetime. However, things like policy value and the insured person's age can cause a considerable price variation. Whole life insurance also offers the potential to build cash value — a living benefit of this type of contract—which may be accessed throughout your lifetime.

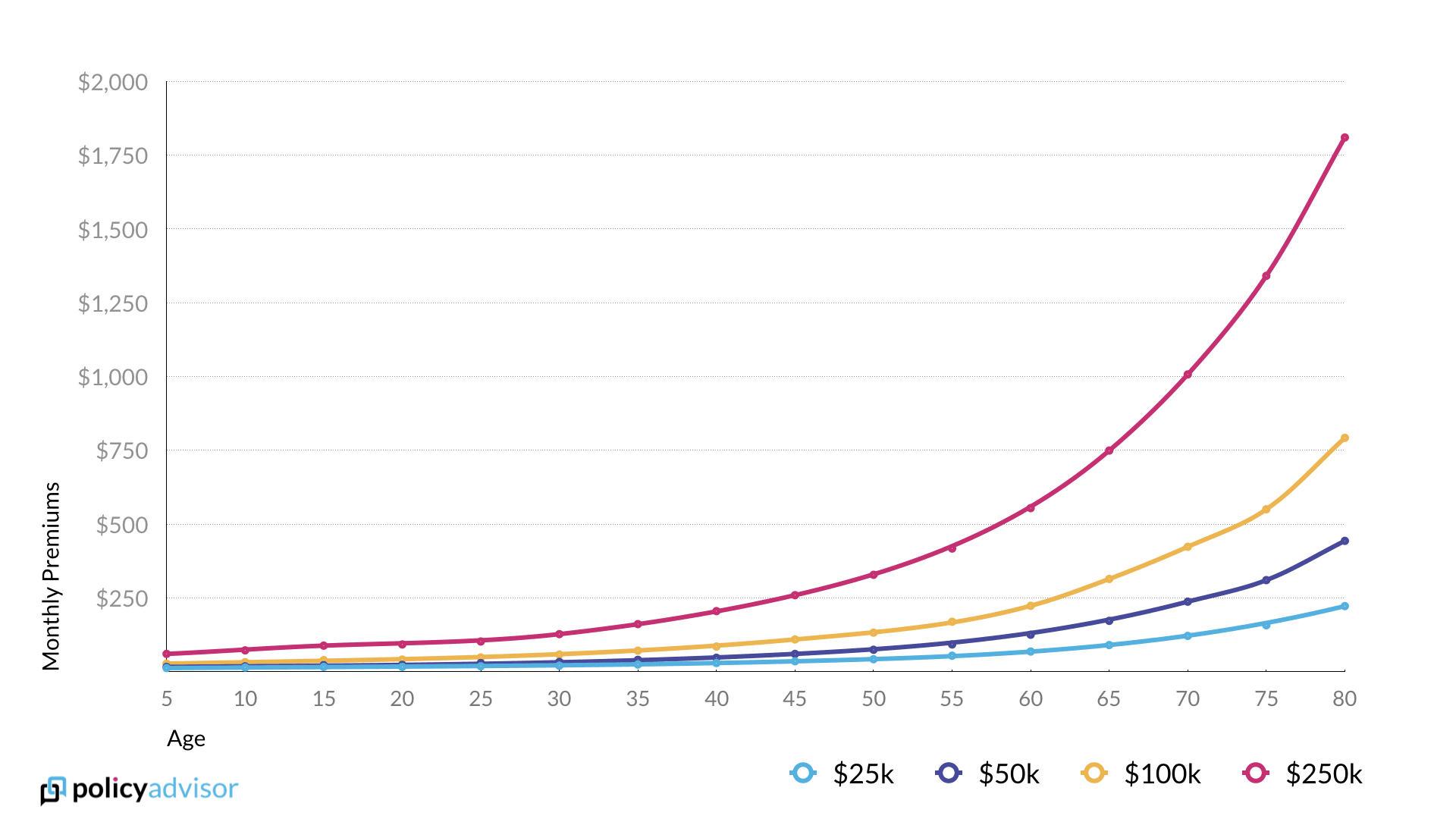

Whole life insurance never expires as long as premiums are. This type of life insurance may make sense if you'd like to use the other benefits of life insurance while you're living, or leave a legacy to family or charitable causes. When it comes to a whole life insurance policy, you have choices. In fact, the average cost of child care alone is $11,582 per child annually, and that doesn’t account for all the other responsibilities they manage. Life insurance costs rise with age, making early enrollment a smart financial move.

Whole Life Insurance Everything To Know Calculator (2023)

Along with typically setting you up with coverage for life, it grows in. A life insurance quote usually depends on things like: Age, gender, coverage amount, term length, payoff age for whole policies, health, and other factors will influence cost. Policy costs can vary greatly depending on your individual circumstance, so it’s really hard to share an average cost of.

average cost of whole life insurance for men

Select the payment option that works best for you. Along with typically setting you up with coverage for life, it grows in. Whole life insurance is a permanent life insurance policy that combines a death benefit with a cash value account you can access during your lifetime. In this section, we've compared the monthly cost of a $50,000 whole life.

Average Cost of Life Insurance (2023) Rates by Age and Gender

In fact, the average cost of child care alone is $11,582 per child annually, and that doesn’t account for all the other responsibilities they manage. $30/month ($10,800 over 30 years). Premiums typically increase by 8% to 10% annually after age 40, meaning the longer you wait, the more you’ll pay. However, that same man would pay $216 per month for.

Average Cost of Life Insurance Factors That Affect It

How much does whole life insurance cost? Whole life insurance is more expensive than term life insurance, and for a good reason: The cost of whole life insurance can vary based on several. A life insurance quote usually depends on things like: What is the average cost of whole life insurance?

How Much Does Whole Life Insurance Cost? PolicyAdvisor

The cost of whole life insurance can vary based on several. Whole life insurance never expires as long as premiums are. Because it doesn't expire like term life, it's usually more expensive. There are primarily two types of life insurance: How much is life insurance?

Average Cost Of Whole Life Insurance - The average cost of life insurance varies based on your age, gender, health, and the amount of coverage. Average cost of whole life insurance. What is the average cost of whole life insurance? In fact, the average cost of child care alone is $11,582 per child annually, and that doesn’t account for all the other responsibilities they manage. Your personal rates depend on your age, gender, health, and hobbies, as well as how much coverage you need. Benzinga tested and reviewed whole life insurance companies for you to compare and find what works best for you.

What is the average cost of whole life insurance per month? There are primarily two types of life insurance: According to our life insurance survey of 1,000 policyholders, 55% said their monthly life insurance premiums are under $100. Don’t wait until it’s too late. How much is a whole life insurance policy per month?

$30/Month ($10,800 Over 30 Years).

Premiums typically increase by 8% to 10% annually after age 40, meaning the longer you wait, the more you’ll pay. Term life and permanent life insurance (which includes whole life and universal life insurance). 2 if you get whole life insurance, the premiums you’ll pay may vary based on factors like your age, health, gender, and the type of policy you get. Select the payment option that works best for you.

But With A Few Assumptions, We’ll Show You A Range Of The Cost.

Premiums are the same until the policy is paid after 20 years. Both insurance policies offer level rates and fixed coverage until the age of 100 or later. $500/month ($180,000 over 30 years). The cost of whole life insurance can vary based on several.

The Following Table Shows Monthly Payments For Insured Individuals Of.

Some reports put the average cost of whole life insurance around $52 per month. Receive coverage from $2,000 to $25,000. Women also pay less than men on average for life insurance. Here are some coverage details.

Policy Costs Can Vary Greatly Depending On Your Individual Circumstance, So It’s Really Hard To Share An Average Cost Of A Whole Life Insurance Policy.

Average cost of whole life insurance. Along with typically setting you up with coverage for life, it grows in. Don’t wait until it’s too late. How to lower your life insurance costs.