Factors Affecting The Insurance Claim Management System

Factors Affecting The Insurance Claim Management System - In the intricate world of insurance, risk assessment and mitigation strategies form the backbone of a robust claims management system. In order to understand the dependency of claims over the sectors and segments, statistical hypothesis testing along with cross tab analysis has been conducted. Let’s see how we can improve the insurance claim process with a strategic approach, technology, and more. In this article, we’ll take a closer look at the challenges carriers face with insurance claims management and the practical solutions they can implement for quick and accurate claims processing. This study explored the actions of policyholders that affect the timeliness of claims settlement (the reporting time of incidence (rtt), understanding of policy’s term and conditions (ptc),. Knowing which of these factors need to be addressed early in the claim, and having specific questions to ask as the claim progresses, can allow claims professionals to offer a.

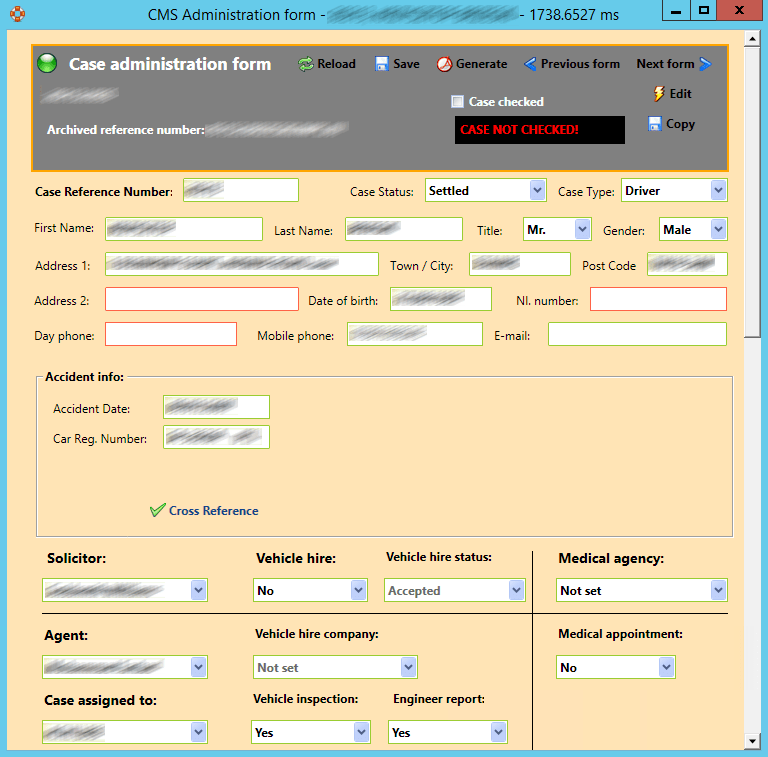

Every organization operates in its own way and each claim is. This study explored the actions of policyholders that affect the timeliness of claims settlement (the reporting time of incidence (rtt), understanding of policy’s term and conditions (ptc),. Claims processing systems are pivotal in managing insurance claims efficiently and accurately. The claims management process is critical for the success of insurance companies, affecting profitability as well as being a key factor in determining overall customer satisfaction. In this blog post, we’ll explore 17 steps that insurance companies can adopt to optimize their claims management processes, ensuring they stay competitive and responsive.

Insurance Claim Management System figma UI design by Hafsa salman l UI

Every organization operates in its own way and each claim is. Claims processing systems are pivotal in managing insurance claims efficiently and accurately. In the intricate world of insurance, risk assessment and mitigation strategies form the backbone of a robust claims management system. In this blog post, we’ll explore 17 steps that insurance companies can adopt to optimize their claims.

Claim Management System designs, themes, templates and downloadable

One of the key factors affecting claims handling efficiency is the organizational structure of the insurance company. Discover how digital automation is helping property insurance carriers simplify and expedite the claims process and overcome challenges posed by a growing number of claims. In the intricate world of insurance, risk assessment and mitigation strategies form the backbone of a robust claims.

Insurance Claim Management System Ux design, Web design, App design

This study explored the actions of policyholders that affect the timeliness of claims settlement (the reporting time of incidence (rtt), understanding of policy’s term and conditions (ptc),. Discover how digital automation is helping property insurance carriers simplify and expedite the claims process and overcome challenges posed by a growing number of claims. The efficiency, effectiveness, and fairness of this process.

Claim Management System Miha Jakovac Coding and Development

At the heart of streamlined claim management lies the insurance claim management system, a technological powerhouse designed to handle the entire lifecycle of a. The claims management process is critical for the success of insurance companies, affecting profitability as well as being a key factor in determining overall customer satisfaction. Importance of effective claims management in insurance Their role enhances.

Insurance Claim Management System Ppt Powerpoint Presentation Complete

Knowing which of these factors need to be addressed early in the claim, and having specific questions to ask as the claim progresses, can allow claims professionals to offer a. The claims management process is critical for the success of insurance companies, affecting profitability as well as being a key factor in determining overall customer satisfaction. These strategies are not.

Factors Affecting The Insurance Claim Management System - In the intricate world of insurance, risk assessment and mitigation strategies form the backbone of a robust claims management system. Every organization operates in its own way and each claim is. The efficiency, effectiveness, and fairness of this process can significantly impact the reputation,. Let’s see how we can improve the insurance claim process with a strategic approach, technology, and more. One of the key factors affecting claims handling efficiency is the organizational structure of the insurance company. Claims management is a most crucial aspect of the insurance industry for several reasons.

Importance of effective claims management in insurance This study explored the actions of policyholders that affect the timeliness of claims settlement (the reporting time of incidence (rtt), understanding of policy’s term and conditions (ptc),. These strategies are not just about. Let’s see how we can improve the insurance claim process with a strategic approach, technology, and more. Knowing which of these factors need to be addressed early in the claim, and having specific questions to ask as the claim progresses, can allow claims professionals to offer a.

In Order To Understand The Dependency Of Claims Over The Sectors And Segments, Statistical Hypothesis Testing Along With Cross Tab Analysis Has Been Conducted.

These strategies are not just about. In this article, we’ll take a closer look at the challenges carriers face with insurance claims management and the practical solutions they can implement for quick and accurate claims processing. Knowing which of these factors need to be addressed early in the claim, and having specific questions to ask as the claim progresses, can allow claims professionals to offer a. In this blog post, we’ll explore 17 steps that insurance companies can adopt to optimize their claims management processes, ensuring they stay competitive and responsive.

At The Heart Of Streamlined Claim Management Lies The Insurance Claim Management System, A Technological Powerhouse Designed To Handle The Entire Lifecycle Of A.

Claims management is a most crucial aspect of the insurance industry for several reasons. In the intricate world of insurance, risk assessment and mitigation strategies form the backbone of a robust claims management system. This study explored the actions of policyholders that affect the timeliness of claims settlement (the reporting time of incidence (rtt), understanding of policy’s term and conditions (ptc),. Discover how digital automation is helping property insurance carriers simplify and expedite the claims process and overcome challenges posed by a growing number of claims.

Importance Of Effective Claims Management In Insurance

Let’s see how we can improve the insurance claim process with a strategic approach, technology, and more. The efficiency, effectiveness, and fairness of this process can significantly impact the reputation,. Their role enhances operational efficiency, minimizes errors, and ultimately. Every organization operates in its own way and each claim is.

One Of The Key Factors Affecting Claims Handling Efficiency Is The Organizational Structure Of The Insurance Company.

Claims processing systems are pivotal in managing insurance claims efficiently and accurately. The claims management process is critical for the success of insurance companies, affecting profitability as well as being a key factor in determining overall customer satisfaction.