Limited Payment Life Insurance Policy

Limited Payment Life Insurance Policy - Limited pay life insurance is a unique whole life insurance option that aligns seamlessly with the perpetual wealth strategy™, offering lifelong benefits without requiring. Several factors influence the cost of your life insurance policy premiums, including:. 1 as a result, it combines a. With limited pay life, you only pay for a set. In the short term, this means your premiums will be more expensive than average. Limited pay life insurance is permanent coverage that allows you to prepay for the entire policy in a set number of years instead of paying over a lifetime.

Limited pay life insurance is a unique whole life insurance option that aligns seamlessly with the perpetual wealth strategy™, offering lifelong benefits without requiring. Find out what a limited pay life policy is, including information about the advantages and disadvantages and how to tell if it's the right choice for you. With limited pay life, you only pay for a set. State farm’s return of premium term life insurance is available in terms of 20 or 30 yearsthe policy can be renewed annually at increasing rates, up to age 95, and you can get. A limited pay life policy allows you to pay off your life insurance in a set number of years.

What is Limited Payment Life Insurance?

State farm’s return of premium term life insurance is available in terms of 20 or 30 yearsthe policy can be renewed annually at increasing rates, up to age 95, and you can get. Limited pay life insurance is permanent coverage that allows you to prepay for the entire policy in a set number of years instead of paying over a.

Here is how much you lose in limited premium payment term life insurance!

Limited pay life insurance is a unique whole life insurance option that aligns seamlessly with the perpetual wealth strategy™, offering lifelong benefits without requiring. In simple words, with a limited pay life insurance, the policyholder has to pay his entire plan’s premiums over a set period instead of over a lifetime. Limited payment life insurance is a form of whole.

A Beginner’s Guide to Limited Payment Whole Life Insurance

Limited pay life insurance from state farm can be completely paid for in 10, 15, or 20 years to help you avoid paying premiums during your retirement. What is a limited pay life insurance policy? Limited pay life insurance policies offer a means to secure permanent coverage within a predetermined timeframe, aimed at providing a policy that is intended to.

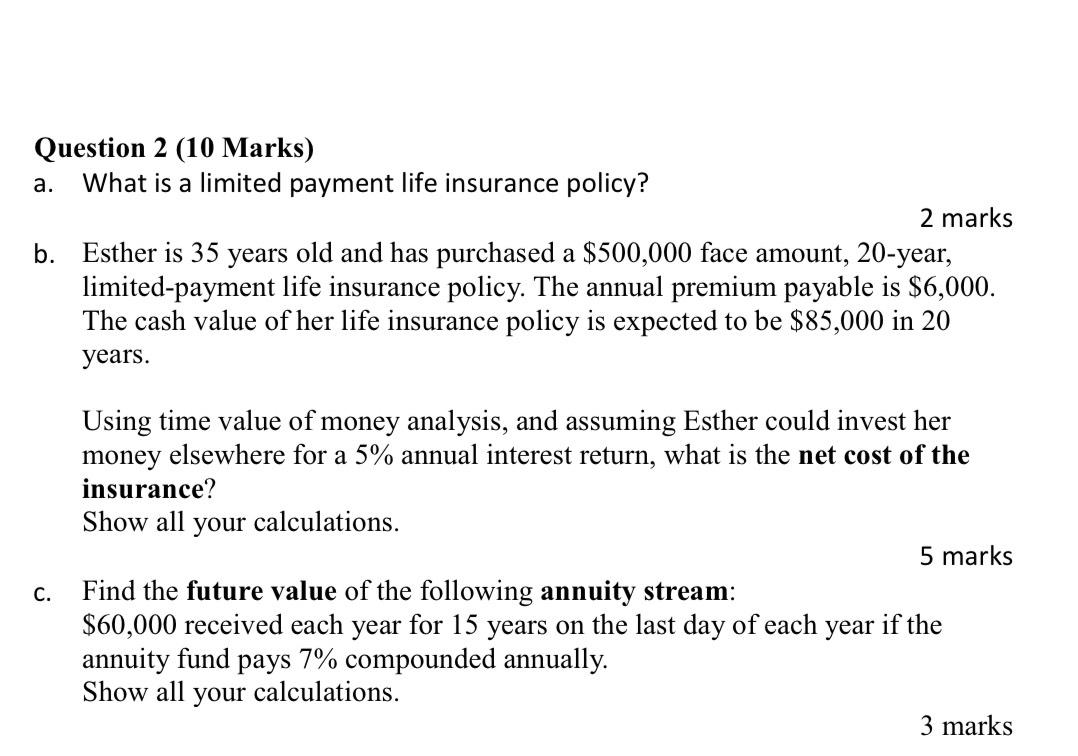

Solved Question 2 (10 Marks) a. What is a limited payment

Limited pay life insurance policies offer a means to secure permanent coverage within a predetermined timeframe, aimed at providing a policy that is intended to be fully paid. Limited pay life insurance is a form of whole life insurance in which premiums are paid over a specified period, after which no further payments are required. A limited pay life insurance.

Limited Payment Life Insurance Policy - In the short term, this means your premiums will be more expensive than average. Some policies offer limited payment periods, such as 10, 20, or 30 years, after which the policy is paid up. Factors affecting life insurance policy costs. Limited pay life insurance policies offer a means to secure permanent coverage within a predetermined timeframe, aimed at providing a policy that is intended to be fully paid. 1 as a result, it combines a. State farm’s return of premium term life insurance is available in terms of 20 or 30 yearsthe policy can be renewed annually at increasing rates, up to age 95, and you can get.

In simple words, with a limited pay life insurance, the policyholder has to pay his entire plan’s premiums over a set period instead of over a lifetime. Limited payment life insurance is a form of whole life insurance that covers you for life, but only requires premium payments for a fixed policy term. Factors affecting life insurance policy costs. Strategic limited partners health insurance typically includes group health benefits and supplemental coverage options tailored to limited partners. Limited pay life insurance from state farm can be completely paid for in 10, 15, or 20 years to help you avoid paying premiums during your retirement.

What Is A Limited Pay Life Insurance Policy?

A limited pay life insurance policy provides lifelong coverage without a lifelong premium payment. Limited pay life insurance from state farm can be completely paid for in 10, 15, or 20 years to help you avoid paying premiums during your retirement. Limited payment life insurance is a form of whole life insurance that covers you for life, but only requires premium payments for a fixed policy term. State farm’s return of premium term life insurance is available in terms of 20 or 30 yearsthe policy can be renewed annually at increasing rates, up to age 95, and you can get.

Some Policies Offer Limited Payment Periods, Such As 10, 20, Or 30 Years, After Which The Policy Is Paid Up.

While primarily sold as whole life. In the short term, this means your premiums will be more expensive than average. Limited pay life insurance policies offer a means to secure permanent coverage within a predetermined timeframe, aimed at providing a policy that is intended to be fully paid. Find out what a limited pay life policy is, including information about the advantages and disadvantages and how to tell if it's the right choice for you.

A Limited Pay Life Policy Allows You To Pay Off Your Life Insurance In A Set Number Of Years.

Limited pay life insurance is a unique whole life insurance option that aligns seamlessly with the perpetual wealth strategy™, offering lifelong benefits without requiring. Younger individuals typically pay lower. Factors affecting life insurance policy costs. 1 as a result, it combines a.

Limited Pay Life Insurance Is A Form Of Whole Life Insurance In Which Premiums Are Paid Over A Specified Period, After Which No Further Payments Are Required.

In simple words, with a limited pay life insurance, the policyholder has to pay his entire plan’s premiums over a set period instead of over a lifetime. Strategic limited partners health insurance typically includes group health benefits and supplemental coverage options tailored to limited partners. Premiums can be paid throughout the life of the policy. With limited pay life, you only pay for a set.